Xinjiang Horgos Company Registration 86-755-82148419 susiehu@citilinkia.com

This is introduction to special economic zones in China, illustrated by the Special Economic Development Zones (SEDZ) of Horgos and Kashgar (Xinjiang province).

According to the <Notice on preferential business income tax policy in the two Special Economic Development Zones of Kashgar and Horgos of Xinjiang> of 29 November 2011 («Notice»), a newly established enterprise in the designated SEDZ Horgos and Kashgar may enjoy a full 5-year tax free period from the EIT provided that at least 70% of the enterprise’s income is generated out of one of the industries specified in the comprehensive «Catalogue of Key Industries Encouraging the Underdeveloped Area of Xinjiang – Enterprise Income Tax» («Catalogue»). Following such 5-year tax free period, the EIT, calculated at the standard rate of 25%, will be reduced by 40% for 2 subsequent years.

The aim of these SEDZ is to boost the economically underdeveloped region of China by providing favorable policies, ranging from tax exemptions, subsidized energy supplies and access to transportation, low-interest loans for infrastructure projects to improvement of rail and flight connections to neighboring countries, notably Kazakhstan.

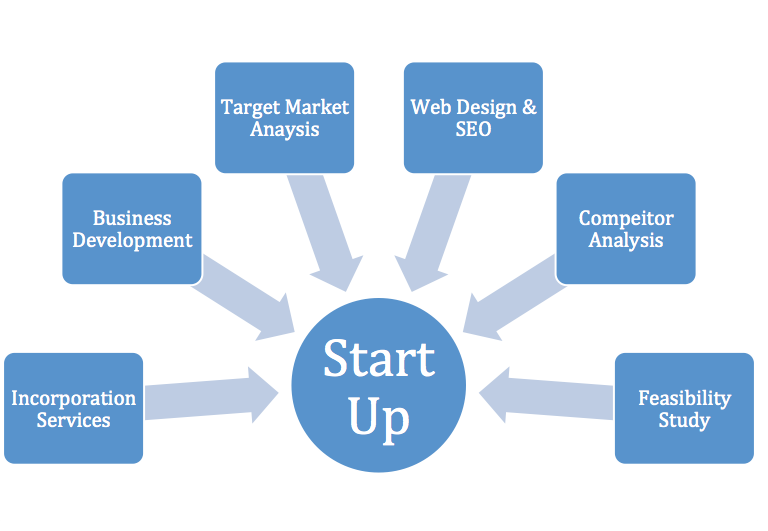

Here we would like to summary five advantages for your reference:

1. The enterprise income tax policy shall be issued by the state council, has been implemented by the taxation bureau and the national taxation bureau through the published articles. Don't worry about local policy changeable

2. Extra-large tax policy

a. Enterprise income taxation shall be free of charge: the enterprise income tax shall be exempted from collection within five years. This policy is the best for all profitable companies and profits to be made.

b. VAT rebates: 15% rebates for over 1 million of company tax revenue, 30% rebates for over 3 million of company tax revenue, and 50% rebates according to the proportion of tax revenue.

3. Third-party service support perfectly: you can designate our company to provide one-stop agency service, including industrial and commercial tax, tax exemption filing, tax return, etc.

4. High-efficiency horgos government office process: according to tax policy, the tax exempt for enterprise income tax could be in one month, the rebate process application is no more than 2 weeks;

5. The preferential policies could benefit the kinds of industries such as culture media, film and television animation, advertising, business services, information technology, software and hardware and game development, investment and other industries.

Xinjiang Horgos Company Registration should be a good choice for investors to invest in western China under the Belt and the Road Initiative.

The Required Documents for Company Registration in Xinjiang Horgos

a. Notarization and legalization of Investor’s identity documents;

b. All members’ passport and ID documents copies;

c. Basis company information.

Contact Us

If you have further inquiries, please do not hesitate to contact Tannet at anytime, anywhere by simply visiting Tannet’s website www.tannet-group.net, or calling Shenzhen hotline at 86-755-82148419 or Hong Kong hotline at 852-27826888, or emailing to susiehu@citilinkia.com. You are also welcome to visit our office situated in16/F, Taiyangdao Bldg 2020,Dongmen Rd South, Luohu , Shenzhen, China.