Zhongshan Tax information

Hotline: 86-755-82143410, Email:2355725105@qq.com

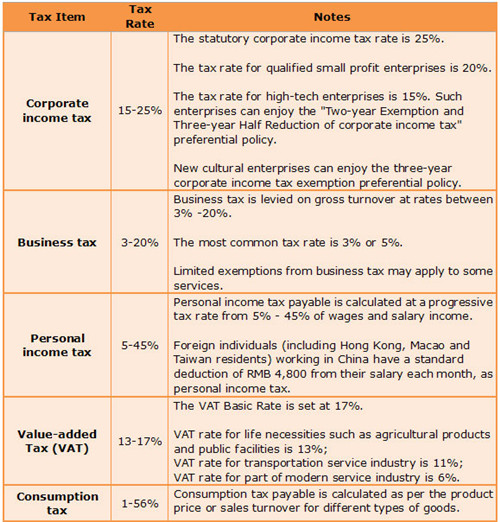

Investing in a place, it is crucial to know the place tax information. Regarding in Zhongshan tax information, please refer to the followings for your referecne. Main types of taxation for Foreign Investment Enterprises (FIE), Foreign Enterprises (FE) and foreign individuals:

Turnover taxes:

Value added tax (VAT);

Business tax; and

Consumption tax;

Income taxes :

Enterprise income tax, and

Individual income tax (IIT);

Other taxes:

Stamp tax,

Deed tax,

Real Property tax,

Land value appreciation tax,

Vehicle purchase tax;

Vehicle and vessel use license tax

Customs duty

Administration of Tax Collection and Share of Revenue

Under the Chinese tax system, the National tax bureaus and offices are responsible for collecting taxes for the Central People's Government while the local tax bureaus and offices are responsible for collecting taxes for local governments. The local customs under the State General Administration of Customs are responsible for collecting import duty, VAT and consumption taxes on imported goods.

Note that Foreign Investment Enterprises, Foreign Enterprises and foreign individual nationals are subject to about 16 types of PRC taxes respectively. In addition, an FIE has a legal obligation to contribute 4 to 5 types of social security payment for local employees under the PRC labor law as promulgated by the NPC, and various PRC social security regulations as issued by the State Council and ministries.

Contact Us

For further queries, please do not hesitate to contact ATAHK at anytime, anywhere by simply calling China hotline at 86-755-82147392,86-755-82143512 or emailing to 2355725092@qq.com.