Applying for Financial Consulting Services

Hotline: 86-755-82148419 Email: susiehu@citilinkia.com

The State Administration of Taxation recently announced the "Measures for the Information Disclosure of Major Taxes and Untrustworthy Cases". These new measures aim to help the implementation of China's new tax law at a regional level; those who fail to comply with the tax law will not be able to leave China until they pay off all overdue taxes. These measures have officially come into effect since the beginning of 2019.

According to article 5, the term “significant tax violations and untrustworthy cases” as used in these measures refer to cases that meet the following criteria:

1. The taxpayer forges, alters, conceals, arbitrarily destroys the accounting book, or lists the expenditures in the book as more than they actually account for, refuses to declare or fabricates false tax returns after receiving notifications from tax authorities. The taxpayer has cheated the system by paying less than RMB 1 million of their taxable income, or paid less than 10% of the total taxable income in any year accounted for.

2. If the taxpayer didn't pay off his/her taxes or obstructs the tax authority from levying taxes by transferring or concealing properties, and the amount of the tax he or she owes is greater than RMB 100,000.

3. Defrauding the state's export tax rebate.

4. Refusing to pay taxes in a violent or threatening manner.

5. Falsely issuing VAT fapiao (invoice) or falsely issuing other fapiaos to defraud export tax rebates and decrease the taxable amount.

6. Falsifying 100 pieces of fapiaos or with a total value of more than RMB 400,000.

7. Privately printing, forging or altering fapiaos, or illegally manufacturing fapiaos.

8. Getting involved in tax evasion, fraudulent export tax rebates, anti-taxation activities, falsely issuing fapiaos, and becoming a fugitive as a result.

9. Other serious violations.

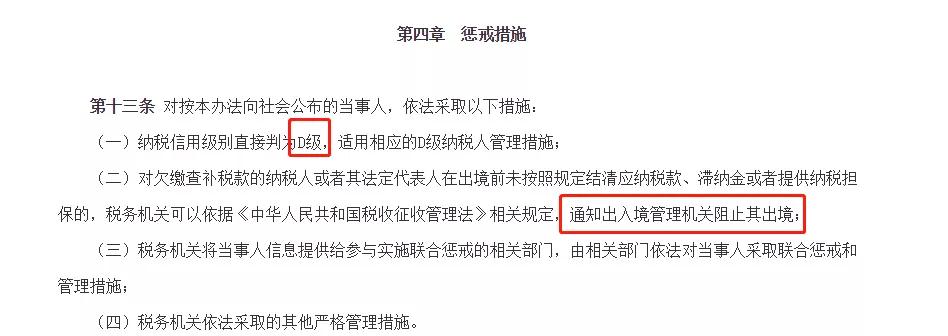

For such taxpayers above, their tax credit rating will be directly subject to a “Class D” rating. The tax authority has the right to notify immigration authorities to prevent them from leaving China.

Class D taxpayers will also face a number of punishments - such as prohibiting high-consumption behaviors, restricting their ability to work in relevant positions, or working for financial institutions.

As of now, those who owe the government over RMB 100,000 in taxes are not allowed to leave China. With the ongoing changing policies, the terms of the punishments will continue to update and, undoubtedly, tighten over time.

The Chinese government has developed a national reputation system called the Social Credit System (Chinese: 社会信用体系; pinyin: shèhuì xìnyòng tǐxì) to rate residents’ spending habits and behaviors. By 2020, it is intended to standardize their assessment and businesses' economic and social reputation, or 'credit'.

ATAHK Services

ATAHK Document Processing Service Center specializes in document process outsourcing service including trade contracts, employment agreements, business plan, investment portfolio, project feasibility study, due diligence, L/C, L/G, and other related documentation. Interpretation and translation services (including legal translation) are also available.

Contact us For Financial Consulting Service

If you have further queries, don’t hesitate to contact ATAHK anytime, anywhere by simply visiting ATAHK’s website www.3737580.net, or calling at 86-755-82148419 or emailing to susiehu@citilinkia.com.