Hong Kong Corporate Formation Service

Hotline: 86-755-82143348/86-13823131503 Email: anitayao@citilinkia.com

Wechat:13823131503

Q:Need Hong Kong company incorporated pay fees to Hong Kong Government?

A: Hong Kong company incorporated needs to pay to Hong Kong Government business registration certificate fee (HKD2,450) and annual return filing fee ( HKD$105) every year.

Q:How Hong Kong company incorporated process annual accounting and auditing?

A: It can entrust professional Certified Public Accountant's firm to process. ATAHK provides complete accounting and auditing services. The company only needs to provide invoices, monthly bank statements, bills, pay record and other information, in which to help conduct accounting and auditing work.

Q:Can ATAHK provide customs declaration and processing banker's letter of credit service?

A: Yes. We provide the aforementioned services. For detailed information, please contact us.

Q:How would Hong Kong company incorporated work without office or employee in Hong Kong?

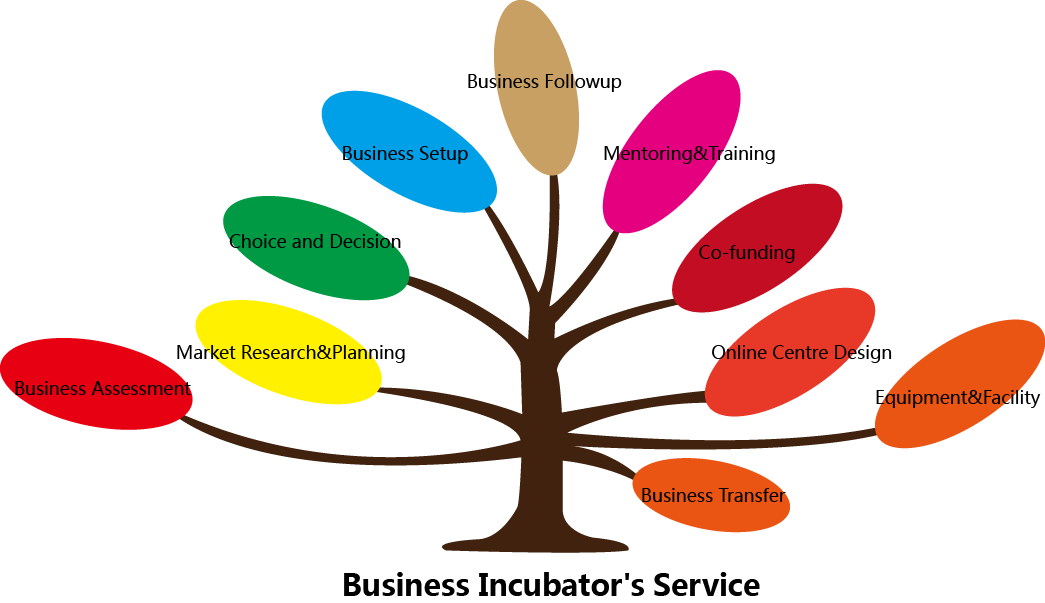

A:The Business Centre Service of ATAHK is catering customers with this need.

Contact Us

If you have further queries, don’t hesitate to contact ATAHK anytime, anywhere by simply visiting ATAHK’s website www.3737580.net , or calling Hong Kong hotline at 852-27826888 or China hotline at 86-755-82143422, or emailing to tannet-solution@hotmail.com