Jiangmen Company Tax Return

Hotline: 86-755-82143348 Email: amyhuang@citilinkia.com

Jiangmen company tax return is the tax form or forms used to report income and file income taxes with Jiangmen tax authorities. Tax returns allow taxpayers to calculate their tax liability and remit payments or request refunds, as the case may be. In most countries, tax returns must be filed every year for an individual or business that received income during the year, whether through wages, interest, dividends, capital gains or other profits.

According to the Chinese law, the taxpayer must file its tax return within the prescribed time, no matter whether it has business turnover. Tax return is a record of your taxable income, calculated over the financial year, and the tax payable on that amount.

Tax Return for Foreign-invested Enterprises

There are 14 kinds of taxes currently applicable to the enterprises with foreign investment, foreign enterprises and/or foreigners, namely: Value Added Tax, Consumption Tax, Business Tax, Income Tax on Enterprises with Foreign Investment and Foreign Enterprises, Individual Income Tax, Resource Tax, Land Appreciation Tax, Urban Real Estate Tax, Vehicle and Vessel Usage License Plate Tax, Stamp Tax, Deed Tax, Slaughter Tax, Agriculture Tax, and Customs Duties.

Tax Return Department - State Administration of Taxation

The State Administration of Taxation is a ministerial-level department within the government of the People's Republic of China. It is under the direction of the State Council, and is responsible for the collection of taxes and enforces the state revenue laws.

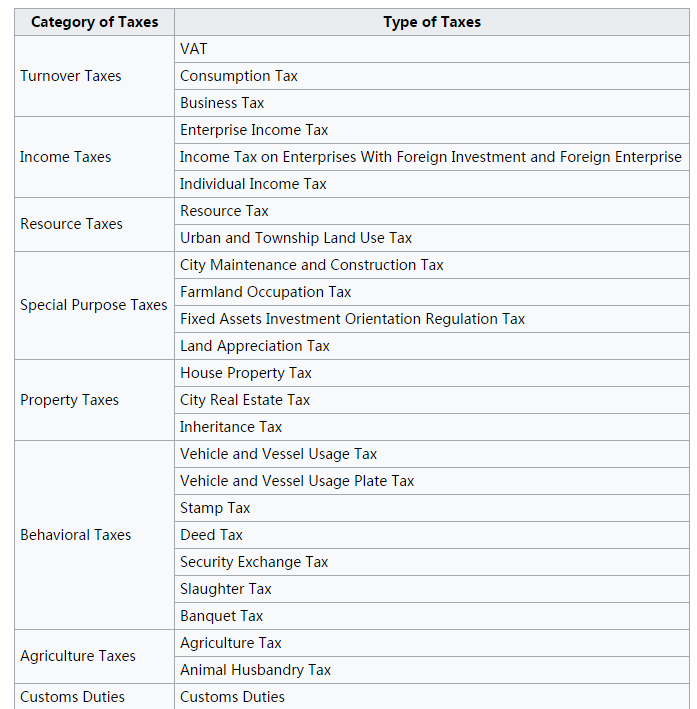

Tax Classification

Our Tax Return Service

We are an excellent corporation outsourcing service provider. We are equipped with a group of experienced workers and thousands of clients over 18 years. We provide taxation consultancy to local and overseas clients, both individuals and corporate, including tax planning, tax return filing, objections and appeals. And our partners are specialized in handling tax investigation and field audit cases.

Contact Us

For further inquiries about investment in China, please do not hesitate to contact us at anytime anywhere by simply calling China hotline at 86-755-82143348, or emailing to amyhuang@citilinkia.com. You are also welcome to visit our office situated in 16/F, Taiyangdao Bldg 2020,Dongmen Rd South, Luohu, Shenzhen, China.